Close

The United Arab Emirates (UAE) has long been recognized as a global business hub, attracting entrepreneurs and multinational corporations with its favorable tax environment and strategic location. At Atmar, we are committed to guiding businesses for a seamless navigation of the UAE tax landscape by exploring the key aspects of the UAE’s taxation system, highlighting recent developments and essential compliance requirements for businesses.

Overview to taxation in the United Arab Emirates

The regulatory authority governing the taxation system in the UAE is the Federal Tax Authority (FTA). Since the announcement in 2023, the UAE did not impose Corporate Tax on business activities following the implementation of Value Added Tax in January, 2018. However, in recent years, the UAE government has introduced new tax regulations to align industry practices & diversify the revenue streams. Major taxes in the Emirates now include Corporate Tax (CT), Value Added Tax (VAT), Excise Tax & Economic Substance Regulations (ESR).

1. Corporate Tax

In 2023, the UAE announced the introduction of a federal corporate tax regime, set to take effect on June 1, 2023. The corporate tax rate is set at 9% on business profits exceeding AED 375,000 for taxable persons. This move aims to boost government revenue and support the country’s economic development while maintaining its competitive edge in attracting foreign investments.

Compliance: Compliance with the UAE’s corporate tax involves understanding and adhering to the new regulations that were introduced in 2023. Companies with business profits exceeding AED 375,000 are subject to a 9% corporate tax. Businesses must register with the Federal Tax Authority (FTA), maintain accurate financial records, and file annual tax returns.

Key concerns

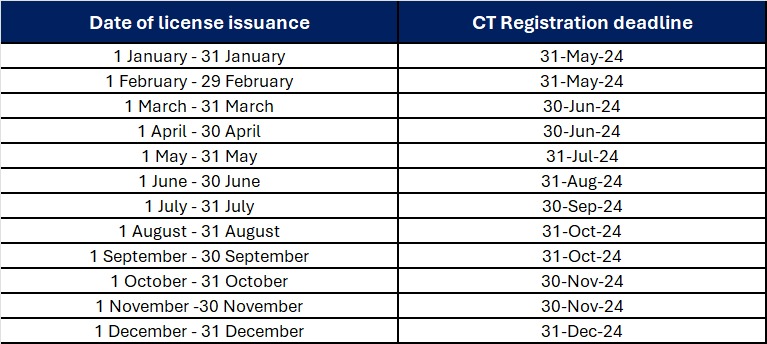

Deadlines for submitting a Tax Registration application

Entities must submit a corporate tax registration application before the deadline, which is as per the license issuance date

9 months from the date of starting a permanent establishment.

Three months from the effective date of this Decision (March 1, 2024)

Within a period not exceeding 6 months from the date of starting a permanent establishment.

Within a period not exceeding 3 months form the date of establishing a nexus.

A resident natural person conducting business or business activities within the UAE during 2024 or subsequent years, with total earned revenues exceeding AED 1 million within a Georgian calendar year, must submit their Corporate Tax registration by March 31 of the following Georgian calendar year.

A non-resident natural person conducting business activities within the UAE during 2024 or subsequent years, and whose total earned revenues exceed AED 1 million, must submit their corporate tax registration application within three months of meeting the corporate tax eligibility criteria.

Penalties for non-compliance*

There are several other penalties of non-compliance under the Cabinet Decision No. 75 of 2023 – Issued 10 July 2023 – (Effective 1 August 2023) & Cabinet Decision No. 10 of 2024 – Issued 22 February 2024 – (Effective 1 March 2024),

* This is a non-exhaustive list of penalties, for complete details, please visit the FTA website.

2.Value Added Tax (VAT)

VAT was introduced in the UAE on January 1, 2018, at a standard rate of 5%. This tax applies to most goods and services, with a few exceptions for specific categories such as healthcare, education, and certain financial services. Businesses are required to register for VAT if their annual taxable supplies and imports exceed AED 375,000. The voluntary registration threshold is AED 187,500

VAT Compliance: Businesses must register for VAT if their taxable supplies and imports exceed AED 375,000 annually. VAT compliance includes issuing proper tax invoices, filing regular VAT returns, and keeping detailed records of all transactions.

Key concerns

Penalties for non-compliance*

* This is a non-exhaustive list of penalties, for complete details, please visit the FTA website.

3. Economic Substance Regulations (ESR)

To comply with international tax standards set by the OECD, the UAE introduced Economic Substance Regulations in 2019. These regulations require certain businesses to demonstrate substantial economic activity within the UAE. Companies engaged in relevant activities, such as banking, insurance, investment fund management, and shipping, must meet specific economic substance tests and file annual reports to the regulatory authorities.

ESR Compliance: Entities conducting relevant activities must file annual Economic Substance Reports demonstrating adequate economic substance in the UAE. This includes meeting core income-generating activities and substantial activity requirements.

Key concerns

*Penalty for non-compliance

* This is a non-exhaustive list of penalties, for complete details, please visit the FTA website.

4. Excise Tax

The UAE also imposes excise tax on specific goods that are harmful to human health or the environment. Introduced in 2017, excise tax applies to products such as tobacco, energy drinks, and carbonated beverages. The rates vary depending on the product category, with the aim of reducing consumption of these goods and promoting a healthier lifestyle.

Excise Tax Compliance: Businesses dealing with excise goods must register for excise tax, submit regular returns, and maintain accurate records of excise goods produced, imported, or stocked.

Key concerns

For details on penalties, please visit the FTA website.

5. Transfer Pricing

As part of its commitment to align with global tax practices, the UAE has also introduced transfer pricing regulations. These rules ensure that transactions between related parties are conducted at arm’s length and reflect market value. Businesses must maintain proper documentation and provide evidence of compliance with transfer pricing rules during tax audits.

For details on penalties, please visit the FTA website.

Compliance with FTA regulations

Ensuring conformity with the UAE’s tax regulations is crucial for businesses to avoid penalties and maintain a good standing with the authorities. Penalties for non-compliance can be substantial and may include fines, interest on unpaid taxes, and even criminal charges in severe cases.

It is essential for businesses to stay updated on regulatory changes and seek professional guidance to navigate the complexities of the tax system.

For complete details on penalties, please visit the FTA website.

Navigate UAE tax landscape with Atmar

Dealing with the complexities of UAE’s taxation system can be challenging, but with the right guidance, it becomes a seamless process. At Atmar, our team of experts is dedicated to helping you understand and comply with all tax regulations, ensuring your business operates efficiently and remains compliant. Whether you need assistance with corporate tax, VAT, excise tax, or economic substance regulations, we are here to provide tailored solutions that meet your specific needs.

Visit us for professional guidance to confidently navigate the evolving tax landscape in the UAE.

Muhammad Tabassam

Manager, Taxation

ATMAR